Struggling to Manage Leads & Clients? This Mortgage CRM Fixes That Instantly!

Your competition is automating their workflows – are you? Stay ahead with a CRM built for modern mortgage pros.

The Modern Mortgage CRM That finally gives you and your team an unfair advantage WITHOUT Tech Headaches & overpriced per user fees

Loan officers and Brokers across the country are ditching contracts with Salesforce, Total Expert, Surefire, Jungo, Bntouch, & Bonzo for a Mortgage CRM that’s more powerful, easier to use, a

fraction of the cost, AND with no contracts.

- click to watch the video!

Finally! A CRM that any originator with any budget can Scale Your Mortgage Business—Without Getting Locked Into Annual Contracts or Nickel-and-Dimed by Per-User Fees!

*Note: This special offer won’t be available for long! Unfortunately, we can’t continue

waiving onboarding costs much longer—so take advantage while you still can.

The Modern Mortgage CRM That finally gives you and your team an unfair advantage WITHOUT Tech Headaches & overpriced per user fees

Loan officers across the country are

ditching contracts with Salesforce, Total Expert, Surefire, Jungo, Bntouch, & Bonzo for a Mortgage CRM that’s more powerful, easier to use, at a fraction of the cost, AND no contracts.

- click to watch the video!

*Note: This offer won’t be available for long! Unfortunately, we can’t continue waiving onboarding costs much longer— take advantage while you still can..

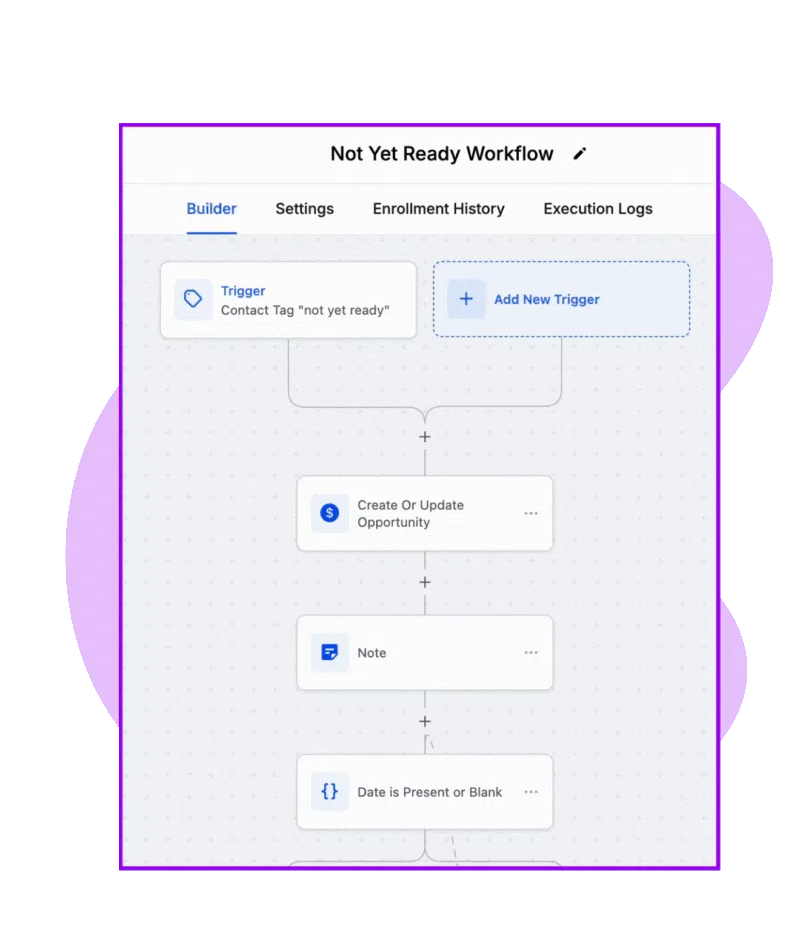

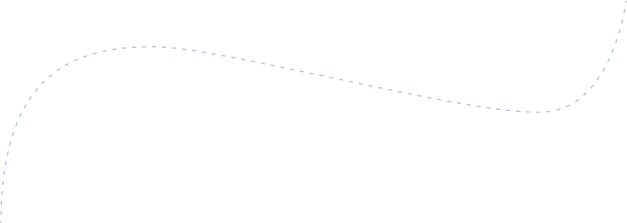

Automated Lead & Client Management

Our automations ensures a consistent, reliable process so nothing falls through the cracks. From lead to post-closing, every step is optimised to deliver a 5-star customer experience—boosting referrals from clients, pre-approvals, agents, and all parties involved!"

How Many of your Mortgages Have Slipped Through The Cracks Because You Forgot to Follow Up?

Think about every client you’ve ever spoken to… every lead that was referred to you… every borrower who almost moved forward but wasn’t quite ready.

Now ask yourself:

How many of them actually purchased or refinanced later... with someone else... simply because you forgot them and they forgot you.

Here's the Truth About Us Loan Officers

We naturally focus on the clients who are:

Motivated

Qualified

Ready to go right now

Of course we do. Who has the time call unmotivated, unqualified, borrowers who are NOT ready? I sure don't and haven't my entire courier.

Of course the challenging part is that those unmotivated, unqualified eventually do qualify and are motivated.

Okay so what about the ones who are:

Motivated but not quite ready

Qualified but not yet motivated

Most of the time we're not the ones who motivate borrowers to buy or sell a home. This is usually triggered by life events, a dream home, or an external push.

But when their time comes...

Will they still remember you?

Most Loan Officers Don't Have a System For This.

Think about it... every single client you've ever talked to will eventually get another loan.

The questions is: Will they get the loan from YOU?

IF you don't have a simple, systematic way to stay in front of every lead you've ever spoken to... you are losing commission checks.

There is a good change someone is purchasing a home right now that you may have talked to 2 years ago but they had forgotten how nice were on the phone that day.

This Changes Everything

Our Automated Lead & Client Management System does the following-up for you.

Every lead gets an estimated loan date based on their plans.

Our system remembers for you, so you never lose track

Whether they're 1, 2, or even 3 years out--we've got you coverd

The best part? Its already built and ready to go.

Just start listening, start asking, and let the system do the rest.

One Tiny Change = Massive Growth

This one simple shift in your daily routine could mean:

More Closed Deals

More Referrals

Less time wasted on cold leads that go nowhere

Automated Lead & Client Management

Our automations ensures a consistent, reliable process so nothing falls through the cracks. From lead to post-closing, every step is optimised to deliver a 5-star customer experience—boosting referrals from clients, pre-approvals, agents, and all parties involved!"

How Many of your Mortgages Have Slipped Through The Cracks Because You Forgot to Follow Up?

Think about every client you’ve ever spoken to… every lead that was referred to you… every borrower who almost moved forward but wasn’t quite ready.

Now ask yourself:

How many of them actually purchased or refinanced later... with someone else... simply because you forgot them and they forgot you.

Here's the Truth About Us Loan Officers

We naturally focus on the clients who are:

Motivated

Qualified

Ready to go right now

Of course we do. Who has the time call unmotivated, unqualified, borrowers who are NOT ready? I sure don't and haven't my entire courier.

Of course the challenging part is that those unmotivated, unqualified eventually do qualify and are motivated.

Okay so what about the ones who are:

Motivated but not quite ready

Qualified but not yet motivated

Most of the time we're not the ones who motivate borrowers to buy or sell a home. This is usually triggered by life events, a dream home, or an external push.

But when their time comes...

Will they still remember you?

Most Loan Officers Don't Have a System For This.

Think about it... every single client you've ever talked to will eventually get another loan.

The questions is: Will they get it from YOU?

IF you don't have a simple, systematic way to stay in front of every lead you've ever spoken to... you are losing commission checks.

There is a good change someone is purchasing a home right now that you may have talked to 2 years ago but they had forgotten how nice were on the phone that day.

This Changes Everything

Our Automated Lead & Client Management System does the following-up for you.

Every lead gets an estimated loan date based on their plans.

Our system remembers for you, so you never lose track

Whether they're 1, 2, or even 3 years out--we've got you coverd

The best part? Its already built and ready to go.

Just start listening, start asking, and let the system do the rest.

One Tiny Change = Massive Growth

This one simple shift in your daily routine could mean:

More Closed Deals

More Referrals

Less time wasted on cold leads that go nowhere

Sales Pipeline Tracking & Management

See exactly where every loan stands – from lead to funding – in one easy-to-use dashboard!

Stay on top of every deal with a structured, automated sales pipeline that tracks progress from lead to post-closing. No more missed deadlines, forgotten tasks, or lost opportunities—just a smooth, consistent process that keeps your team and clients informed every step of the way!

You’re Great at

Getting Loans… But Can Your Business Scale with Out sacrafising service?

As a successful loan officer, you know where your time is best spent:

🔥 Following Up with Prospects

🔥 Connecting with Referral Partners

🔥 Stratagizing on your business

🔥 Creating video content

The more time you focus on these money-making activities, the more loans you close. Simple, Right?

But heres the Problem...

The moment you start winning more business, another challenge appears:

👉 How do you manage, fulfill, and close every loan flawlessly—without dropping the ball?

The Big Challenge: Growth vs. Fulfilment

You get great at building relationships → Now you have a flood of deals.

More deals = More work managing the process, the deadlines, and the details.

Every missed step risks a delayed closing, an unhappy client, an upset realtor, or even a lost deal

Now, imagine you’re closing 4-5 loans a month and suddenly 10 more deals hit your pipeline.

How do you scale up—without chaos?

This Is Why You Need a Pipeline Management System

🚀 Our Proprietary Pipeline Management System Does Heavy Lifting For You.

Track Every Loan From Start To Finish--From Disclosures to Closing

Automate key tasks & deadlines so nothing slips through the cracks.

Streamline Communication between you, your team, and all parties involved.

Provide a 5 - Star borrower experience--without adding more stress to your plate.

Scale with ease--A done for you pipeline management system thats ready for your massive growth and success.

This system is a complete blueprint of the mortgage process, built for growth.

💥 Dream Big CRM has done all the hard work for you.

💰 The bigger your pipeline, the more money you make. Lets help you manage your business like a pro.

Sales Pipeline Tracking & Management

See exactly where every loan stands – from lead to funding – in one easy-to-use dashboard!

Stay on top of every deal with a structured, automated sales pipeline that tracks progress from lead to post-closing. No more missed deadlines, forgotten tasks, or lost opportunities—just a smooth, consistent process that keeps your team and clients informed every step of the way!

You’re Great at

Getting Loans… But Can Your Business Scale with out sacrificing service?

As a successful loan officer, you know where your time is best spent:

🔥 Following Up with Prospects

🔥 Connecting with Referral Partners

🔥 Stratagizing on your business

🔥 Creating video content

The more time you focus on these money-making activities, the more loans you close. Simple, Right?

But heres the Problem...

The moment you start winning more business, another challenge appears:

👉 How do you manage, fulfill, and close every loan flawlessly—without dropping the ball?

The Big Challenge: Growth vs. Fulfilment

You get great at building relationships → Now you have a flood of deals.

More deals = More work managing the process, the deadlines, and the details.

Every missed step risks a delayed closing, an unhappy client, an upset realtor, or even a lost deal

Now, imagine you’re closing 4-5 loans a month and suddenly 10 more deals hit your pipeline.

How do you scale up—without chaos?

This Is Why You Need a Pipeline Management System

🚀 Our Proprietary Pipeline Management System Does Heavy Lifting For You.

Track Every Loan From Start To Finish--From Disclosures to Closing

Automate key tasks & deadlines so nothing slips through the cracks.

Streamline Communication between you, your team, and all parties involved.

Provide a 5 - Star borrower experience--without adding more stress to your plate.

Scale with ease--A done for you pipeline management system thats ready for your massive growth and success.

This system is a complete blueprint of the mortgage process, built for growth.

💥 Dream Big CRM has done all the hard work for you.

💰 The bigger your pipeline, the more money you make. Lets help you manage your business like a pro.

2-Way Communication Dashboard

Streamline communication across your entire team with a centralised dashboard! View and manage all client interactions—texts, emails, calls, and social messages—in one place. Collaborate seamlessly by messaging team members directly within each lead, client, or past client profile, ensuring nothing slips through the cracks! 🚀

Your Mortgage Business Runs on Communication… But Can Your Communication System Keep Up?

To run a high-volume, high-profit mortgage business, you need a badass communication system that works for:

You

Your Team

Your Realtors

And most importantly your leads & clients

For years, I searched for the PERFECT texting & communication platform that:

📲 Worked with my current office phone number

📩 Integrated with my CRM

⚡️Made 2-way SMS fast, easy, seamless, and work for my entire team.

I tried everything. NOTHING worked.

I Thought I Finally Found a Solution...

I pieced multiple platforms together—kind of like duct-taping your engine together while racing in the Indy 500, HOPING to win. 🚀🏎️

🚨 The Cost?

💰 $99/month for phone system

💰 $150/month for CRM system

💰 $150/month for additional users on the CRM

💰 Additional fees from every text sent

And even after all that money... the user experience was nothing short of TERRIBLE...

There was no central dashboard.

No way to see all conversations in one place.

No way for my team to instantly step in and respond.

That’s Why This 2-way Communication Dashboard is a Game-Changer!

🚀 Imagine a Communication Dashboard Where:

Every phone call, text message, email, and even social media DM (Facebook, Instagram, WhatsApp) is in ONE place.

Your entire team can see conversations and respond instantly.

Group Messaging/sms native your your Communication Dashboard.

A client texts you while you’re in an appointment? Your team can reply—no more missed opportunities.

Going on vacation? Your business keeps running because your team sees every message and jumps in.

No more chasing team members—just tag them in a conversation, and they know exactly what to do.

Call recordings & transcriptions keep everyone on the same page—so nothing gets lost.

Now, its fully built into Dream Big CRM.

Your Business Just Got More Efficient.

No more scrambling. No more team member confusion. No more duck taping your systems together.

🔥 This is the communication system I wish I had years ago.

🔥 And now, its available for you—without the crazy additional fees.

💥 Stop struggling for seamless communication between clients, your team, and referral partners.

2-Way Communication Dashboard

Streamline communication across your entire team with a centralized dashboard! View and manage all client interactions—texts, emails, calls, and social messages—in one place. Collaborate seamlessly by messaging team members directly within each lead, client, or past client profile, ensuring nothing slips through the cracks! 🚀

Your Mortgage Business Runs on Communication… But Can Your Communication System Keep Up?

To run a high-volume, high-profit mortgage business, you need a badass communication system that works for:

You

Your Team

Your Realtors

And most importantly your leads & clients

For years, I searched for the PERFECT texting & communication platform that:

📲 Worked with my current office phone number

📩 Integrated with my CRM

⚡️Made 2-way SMS fast, easy, seamless, and work for my entire team.

I tried everything. NOTHING worked.

I Thought I Finally Found a Solution...

I pieced multiple platforms together—kind of like duct-taping your engine together while racing in the Indy 500, HOPING to win. 🚀🏎️

🚨 The Cost?

💰 $99/month for phone system

💰 $150/month for CRM system

💰 $150/month for additional users on the CRM

💰 Additional fees fro every text sent

And even after all that money... the user experience was nothing short of TERRIBLE...

There was no central dashboard.

No way to see all conversations in one place.

No way for my team to instantly step in and respond.

That’s Why This 2-way Communication Dashboard is a Game-Changer!

🚀 Imagine a Communication Dashboard Where:

Every phone call, text message, email, and even social media DM (Facebook, Instagram, WhatsApp) is in ONE place.

Your entire team can see conversations and respond instantly.

Group Messaging/sms native your your Communication Dashboard.

A client texts you while you’re in an appointment? Your team can reply—no more missed opportunities.

Going on vacation? Your business keeps running because your team sees every message and jumps in.

No more chasing team members—just tag them in a conversation, and they know exactly what to do.

Call recordings & transcriptions keep everyone on the same page—so nothing gets lost.

Before, I would have paid easily $300-$400/month JUST for this 2 - way Communication system…

Now, its fully built into Dream Big CRM.

Your Business Just Got More Efficient

No more scrambling. No more team member confusion. No more duck taping your systems together.

🔥 This is the communication system I wish I had years ago.

🔥 And now, its available for you—without the crazy additional fees.

💥 Stop struggling for seamless communication between clients, your team, and referral partners.

Skyrocket Your 5-Star Reviews 🚀with Automated Reputation Management!

Turn happy clients into raving fans! Our automation requests, tracks, and manages reviews—boosting your online reputation effortlessly. Automatically add these reviews to social media, your website and email templates. More positive reviews mean more trust, more referrals, and more closed deals Please rewrite this subtext

Want More Clients? Build Your 5-Star Reputation on Autopilot

Every top-producing loan officer knows that reviews = trust… and trust closes more deals.

But heres the question:

👉 Do you have a system for capturing client reviews after every single loan?

For years I didn't.

My Biggest Fear Holding Me Back from More Reviews…

Early in my career, I was afraid to ask for reviews.

Why? Because I didn’t want to risk getting a 1-star review.

So instead, I would:

Call the client first, ask if they were happy, then...

Manually email them a link and hope 🙏🏼 they left a review.

The Result? Inconsistent reviews.

Some months I'd get a few, and other months I'd get none.

Then I made one simple change...

I Built a System That Asked Every Client for a Review Automatically

The moment I turned this system on, my

5-star reviews exploded 🚀

I used to pay companies like Podium ($299/month) just to help me collect and display reviews.

I even paid extra for a widget to showcase the reviews on my website.

💰 It was worth every penny… but it still wasn’t the best solution.

Now? Our system does all of that—built right into Dream Big CRM.

This Is NOT Just a Simple Review Request… It’s a Proven System That Works.

❌ It’s NOT just sending a link and hoping the client leaves a review.

It’s a specific workflow, sequence, and system designed to motivate clients to take action.

It’s a proven process that has already generated millions of online 5-star reviews.

How It Works (And Why It's a Game Changer)

Reviews Happen on Autopilot—No more awkward “Hey, can you leave me a review?” conversations.

You control where reviews go—Google, Zillow, Yelp, Experience.com, Facebook—you name it.

Seamlessly showcase your best reviews—On your website, in pre-approval letters, loan application requests, and more.

Boost your trust & credibility across All Marketing—Trust is built faster & easier

Transform your past clients into a steady stream of 5-star reviews—our proprietary system re-engages happy clients and ensures they share their great experience with the world.

Other business's Pay Hundreds Per Month for the Same reputation management System… You Get It Included in your subscription

This exact reputation management system is sold for $199/month to other business owners across the country and has generated millions of 5-star reviews and we have included this for free with your monthly subscription.

Your Reviews Will Pay You Dividends for Years

💡 More 5-star reviews = more trust = more closed loans.

💡More social proof = higher conversion rates on every lead.

And the best part? It’s already done for you.

Skyrocket Your 5-Star Reviews 🚀with Automated Reputation Management!

Turn happy clients into raving fans! Our automation requests, tracks, and manages reviews—boosting your online reputation effortlessly. Automatically add these reviews to social media, your website and email templates. More positive reviews mean more trust, more referrals, and more closed deals Please rewrite this subtext

Want More Clients? Build Your 5-Star Reputation on Autopilot

Every top-producing loan officer knows that reviews = trust… and trust closes more deals.

But heres the question:

👉 Do you have a system for capturing client reviews after every single loan?

For years I didn't.

The Biggest Fear Holding Me Back from More Reviews…

Early in my career, I was afraid to ask for reviews.

Why? Because I didn’t want to risk getting a 1-star review.

So instead, I would:

Call the client first, ask if they were happy, then...

Manually email them a link and hope 🙏🏼 they left a review.

The Result? Inconsistent reviews.

Some months I'd get a few, and other months I'd get none.

Then I made one simple change...

I Built a System That Asked Every Client for a Review Automatically

The moment I turned this system on, my

5-star reviews exploded 🚀

I used to pay companies like Podium ($299/month) just to help me collect and display reviews.

I even paid extra for a widget to showcase the reviews on my website.

💰 It was worth every penny… but it still wasn’t the best solution.

Now? Our system does all of that—built right into Dream Big CRM.

This Is NOT Just a Simple Review Request… It’s a Proven System That Works.

❌ It’s NOT just sending a link and hoping the client leaves a review.

It’s a specific workflow, sequence, and system designed to motivate clients to take action.

It’s a proven process that has already generated millions of online 5-star reviews.

How It Works (And Why It's a Game Changer)

Reviews Happen on Autopilot—No more awkward “Hey, can you leave me a review?” conversations.

You control where reviews go—Google, Zillow, Yelp, Experience.com, Facebook—you name it.

Seamlessly showcase your best reviews—On your website, in pre-approval letters, loan application requests, and more.

Boost your trust & credibility across All Marketing—Trust is built faster & easier

Transform your past clients into a steady stream of 5-star reviews—our proprietary system re-engages happy clients and ensures they share their great experience with the world.

Other business's Pay Hundreds Per Month for This Same Exact reputation management System… You Get It Included in your subscription

This exact reputation management system is sold for $199/month to other business owners across the country and has generated millions of 5-star reviews and we have included this for free with your monthly subscription.

Your Reviews Will Pay You Dividends for Years

💡 More 5-star reviews = more trust = more closed loans.

💡More social proof = higher conversion rates on every lead.

And the best part? It’s already done for you.

Robust Email Campaigns (with Analytics & A/B Testing)

Engage new leads and keep pre-approved and in-contract clients informed with automated email and text campaigns. Personalize messaging, track open rates and link clicks, and optimize every send with A/B testing—ensuring higher conversions, better communication, and a seamless loan experience!🚀

Your Email Marketing Strategy is Costing You Deals… Here’s Why

Let’s be honest… using Outlook or Gmail alone isn’t enough anymore.

Sure, they’re great for sending one-on-one emails.

But when it comes to marketing at scale—reaching your past clients, realtors, and database in a way that is:

🔥 Impactful

🔥 Memorable

🔥 Constistant

You need something better.

The Problem With Duct-Taping Your Email System Together

Ive tried it all...

📩 Mailchimp for email marketing

🎥 BombBomb for video emails

💾 Salesforce for CRM & contact management

And I made them all “talk” to each other.

I set up integrations so new contacts were categorised correctly—first-time buyers, realtors, past clients, etc.

I hired a tech person to manage it when things broke (which happened a lot).

I was constantly paying for multiple platforms just to send emails the way I wanted.

💰It worked… but it was expensive, frustrating, and inefficient.

Then I Switched my email system to Dream Big CRM—And Everything Changed

🚀 One system. One platform. Everything built in.

No more juggling multiple email tools—it’s all inside your CRM.

Cancel your expensive email software—you won’t need it anymore.

Easily embed videos, reviews, HTML widgets, & more in every email.

Custom email domains for serious marketers—keep your reputation A+.

Industry-leading email analytics—track open rates, click-through rates, and deliverability in real-time.

Why Your Email Reputation Matters More Than You Think

Most loan officers are unaware that platforms like Gmail, Outlook, and Yahoo track every email you send.

❌ If too many of your emails land in spam, your email reputation drops.

❌ If too many emails bounce, your future emails get blocked.

❌ If too few people open your emails, your deliverability plummets.

🔑 Think of your email reputation like your credit score. The higher it is, the better your emails perform.

Dream Big CRM gives you a massive advantage.

Our built-in system protects your email reputation, ensuring your messages land in inboxes, not spam folders.

Done-For-You Email Templates (That Convert Like Crazy)

Not only do you get a powerful email system, but we’ve also built out:

📩 50+ pre-written email templates—ready to use on day one.

📆 Fully automated loan process emails—so your clients, agents, and team are always on the same page.

🛠 Easy customisation—don’t like the wording? Edit them in seconds.

Here’s Why Realtors & Clients Will LOVE Your Emails

💡 Every email includes:

The number of days left to close.

Important dates like closing & contingency deadlines.

A clear timeline of the loan process

📌 Realtors will love the transparency.

📌 Clients will feel informed & taken care of.

📌 You’ll instantly stand out from 99% of other loan officers.

Turn Your Email Marketing Into a Deal-Closing Machine

🚀 Create powerful email campaigns

🚀 Set up automated follow-ups

🚀 Launch high-converting email sequences—with ZERO tech headaches

💥 I wish I had this system years ago.

Now? It’s built into Dream Big CRM—ready for you to use TODAY.

Robust Email Campaigns (with Analytics & A/B Testing)

Engage new leads and keep pre-approved and in-contract clients informed with automated email and text campaigns. Personalize messaging, track open rates and link clicks, and optimize every send with A/B testing—ensuring higher conversions, better communication, and a seamless loan experience!🚀

Your Email Marketing Strategy is Costing You Deals… Here’s Why

Let’s be honest… using Outlook or Gmail alone isn’t enough anymore.

Sure, they’re great for sending one-on-one emails.

But when it comes to marketing at scale—reaching your past clients, realtors, and database in a way that is:

🔥 Impactful

🔥 Memorable

🔥 Constistant

You need something better.

The Problem With Duct-Taping Your Email System Together

Ive tried it all...

📩 Mailchimp for email marketing

🎥 BombBomb for video emails

💾 Salesforce for CRM & contact management

And I made them all “talk” to each other.

I set up integrations so new contacts were categorised correctly—first-time buyers, realtors, past clients, etc.

I hired a tech person to manage it when things broke (which happened a lot).

I was constantly paying for multiple platforms just to send emails the way I wanted.

💰It worked… but it was expensive, frustrating, and inefficient.

Then I Switched my email system to Dream Big CRM—And Everything Changed

🚀 One system. One platform. Everything built in.

No more juggling multiple email tools—it’s all inside your CRM.

Cancel your expensive email software—you won’t need it anymore.

Easily embed videos, reviews, HTML widgets, & more in every email.

Custom email domains for serious marketers—keep your reputation A+.

Industry-leading email analytics—track open rates, click-through rates, and deliverability in real-time.

Why Your Email Reputation Matters More Than You Think

Most loan officers are unaware that platforms like Gmail, Outlook, and Yahoo track every email you send.

❌ If too many of your emails land in spam, your email reputation drops.

❌ If too many emails bounce, your future emails get blocked.

❌ If too few people open your emails, your deliverability plummets.

🔑 Think of your email reputation like your credit score. The higher it is, the better your emails perform.

Dream Big CRM gives you a massive advantage.

Our built-in system protects your email reputation, ensuring your messages land in inboxes, not spam folders.

Done-For-You Email Templates (That Convert Like Crazy)

Not only do you get a powerful email system, but we’ve also built out:

📩 50+ pre-written email templates—ready to use on day one.

📆 Fully automated loan process emails—so your clients, agents, and team are always on the same page.

🛠 Easy customisation—don’t like the wording? Edit them in seconds.

Here’s Why Realtors & Clients Will LOVE Your Emails

💡 Every email includes:

The number of days left to close.

Important dates like closing & contingency deadlines.

A clear timeline of the loan process

📌 Realtors will love the transparency.

📌 Clients will feel informed & taken care of.

📌 You’ll instantly stand out from 99% of other loan officers.

Turn Your Email Marketing Into a Deal-Closing Machine

🚀 Create powerful email campaigns

🚀 Set up automated follow-ups

🚀 Launch high-converting email sequences—with ZERO tech headaches

💥 I wish I had this system years ago.

Now? It’s built into Dream Big CRM—ready for you to use TODAY.

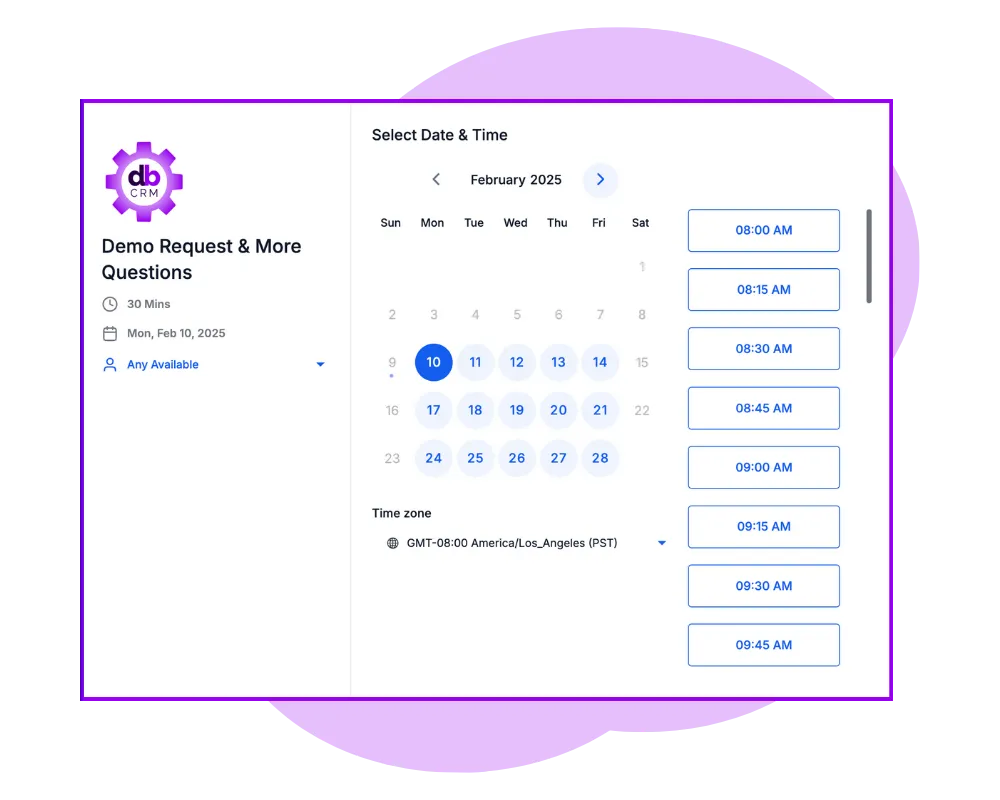

Built-in Video Calendar &

Appointment Booking

Say goodbye to scheduling headaches and costly third-party tools like Calendly! Our built-in calendar lets clients, agents, and team members book appointments instantly—right inside your CRM. Automate reminders, reduce no-shows, and keep your pipeline moving without the endless back-and-forth emails!

If You’re Not Using a Video Appointment System, You’re Losing Deals

COVID changed the world in a lot of ways…

But for loan officers, it completely revolutionised how we do business.

Before? Phone calls and in-person meetings were the norm.

Now? Video appointments are the new standard.

And honestly? This is a game-changer.

Why Video Appointments can be MORE Effective Than In-Person Meetings

You have full control over the meeting—screen sharing, presentations, visuals—all at your fingertips.

Your clients are more comfortable—they don’t have to drive, schedule time off, or meet in person.

You’re no longer limited by geography—you can now close loans in ANY city, ANY state, ANY market.

🚀 This is why my business has exploded.

Not just because of COVID—but because I embraced video appointments.

Want Bigger Loans? More Clients? Stop Limiting Yourself to One Market.

If your local market is slow…

If loan sizes in your area are small…

If you want to expand your reach beyond your city…

The solution is simple:

💡 Start using video appointments.

💡 Start taking clients from anywhere in the country.

💡 Start making it EASY for clients to schedule time with you.

But to do that, you need a frictionless calendar booking system.

Calendly Used to Be My Go-To… Until I Found Something Better

For years, I used Calendly (the industry standard for scheduling appointments).

I duct-taped it together with Salesforce to track meetings and send reminders.

It worked… but it had major limitations.

❌ No way to screen appointments before they landed on my calendar.

❌ No easy tracking system of how many appointments I had per week, month, or quarter.

❌ No built-in filtering for credit scores, income, or qualifications. I wasted a lot of time...

❌ No way to automate confirmations without my team manually calling leads.

Then I switched to Dream Big CRM’s Calendar & Appointment System—and everything changed.

The Ultimate Scheduling System for Loan Officers

With Dream Big CRM, you get a fully automated calendar booking system that:

Lets clients, leads, & realtors book time with you effortlessly (replaced calendly)

Includes 3 ready-to-use calendars:

👉🏼 15-minute phone appt 📞

👉🏼 Video/Zoom appointment 🎥

👉🏼 In-person meeting 📍

Prevents unqualified leads from booking time with you—no more wasted calls.

Automatically confirms appointments & sends reminders (so your team doesn’t have to).

Tracks all your appointments & conversion rates—so you can measure and improve.

Seamlessly inside your CRM—every meeting is logged, tracked, and optimized.

Here’s How It Works (And Why It’s a Game-Changer) with your lead forms

🚀 Lead submits an online form → If they qualify, they can schedule an appointment.

🚀 If they don’t qualify? They’re redirected to a page with next steps (credit improvement, more income, etc.).

🚀 Once booked:

Automatic confirmation sent to the client.

Meeting invite added to their calendar.

Reminders sent leading up to the appointment

Easy access to join the Zoom meeting or directions to your office location.

I no longer have to manually confirm meetings, track no-shows, or waste time on unqualified leads.

💡 It’s all done automatically.

Track & Scale Your Appointments Like a True Business Owner

Before, I had no real way of tracking:

📊 How many appointments I had per week or month

📊 How many of those appointments turned into applications

📊 How many applications turned into closings

Now, with my custom appointment dashboard, I can measure & improve every step.

And the best part? 🚀

👉 This calendar system is INCLUDED for FREE with your Dream Big CRM subscription.

Start Booking More Appointments & Closing More Deals Today

💥 No more wasting time on the wrong prospects.

💥 No more manually confirming meetings.

💥 No more relying on multiple systems to get the job done.

🚀 Book more appointments. Close more loans. Scale your business.

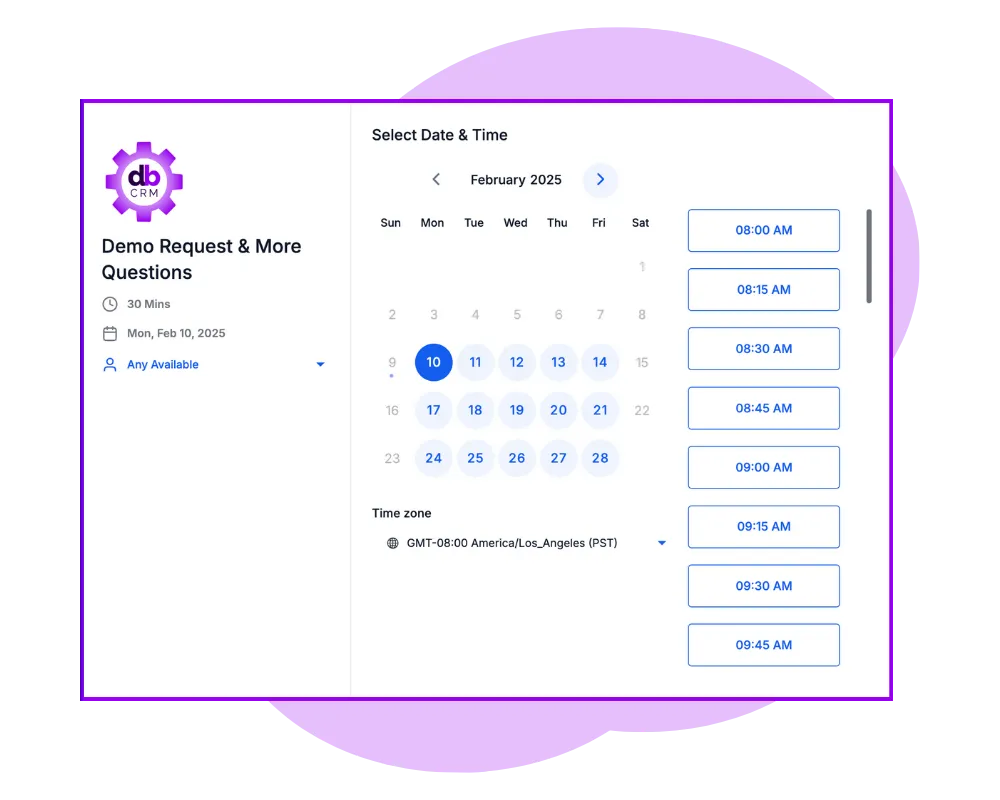

Built-in Video Calendar &

Appointment Booking

Say goodbye to scheduling headaches and costly third-party tools like Calendly! Our built-in calendar lets clients, agents, and team members book appointments instantly—right inside your CRM. Automate reminders, reduce no-shows, and keep your pipeline moving without the endless back-and-forth emails!

If You’re Not Using a Video Appointment System, You’re Losing Deals

COVID changed the world in a lot of ways…

But for loan officers, it completely revolutionised how we do business.

Before? Phone calls and in-person meetings were the norm.

Now? Video appointments are the new standard.

And honestly? This is a game-changer.

Why Video Appointments can be MORE Effective Than In-Person Meetings

You have full control over the meeting—screen sharing, presentations, visuals—all at your fingertips.

Your clients are more comfortable—they don’t have to drive, schedule time off, or meet in person.

You’re no longer limited by geography—you can now close loans in ANY city, ANY state, ANY market.

🚀 This is why my business has exploded.

Not just because of COVID—but because I embraced video appointments.

Want Bigger Loans? More Clients? Stop Limiting Yourself to One Market.

If your local market is slow…

If loan sizes in your area are small…

If you want to expand your reach beyond your city…

The solution is simple:

💡 Start using video appointments.

💡 Start taking clients from anywhere in the country.

💡 Start making it EASY for clients to schedule time with you.

But to do that, you need a frictionless calendar booking system.

Calendly Used to Be My Go-To… Until I Found Something Better

For years, I used Calendly (the industry standard for scheduling appointments).

I duct-taped it together with Salesforce to track meetings and send reminders.

It worked… but it had major limitations.

❌ No way to screen appointments before they landed on my calendar.

❌ No easy tracking system of how many appointments I had per week, month, or quarter.

❌ No built-in filtering for credit scores, income, or qualifications. I wasted a lot of time...

❌ No way to automate confirmations without my team manually calling leads.

Then I switched to Dream Big CRM’s Calendar & Appointment System—and everything changed.

The Ultimate Scheduling System for Loan Officers

With Dream Big CRM, you get a fully automated calendar booking system that:

Lets clients, leads, & realtors book time with you effortlessly (replaced calendly)

Includes 3 ready-to-use calendars:

👉🏼 15-minute phone appointment 📞

👉🏼 Video/Zoom appointment 🎥

👉🏼 In-person meeting 📍

Prevents unqualified leads from booking time with you—no more wasted calls.

Automatically confirms appointments & sends reminders (so your team doesn’t have to).

Tracks all your appointments & conversion rates—so you can measure and improve.

Seamlessly inside your CRM—every meeting is logged, tracked, and optimized.

Here’s How It Works (And Why It’s a Game-Changer) with your lead forms

🚀 Lead submits an online form → If they qualify, they can schedule an appointment.

🚀 If they don’t qualify? They’re redirected to a page with next steps (credit improvement, more income, etc.).

🚀 Once booked:

Automatic confirmation sent to the client.

Meeting invite added to their calendar.

Reminders sent leading up to the appointment

Easy access to join the Zoom meeting or directions to your office location.

I no longer have to manually confirm meetings, track no-shows, or waste time on unqualified leads.

💡 It’s all done automatically.

Track & Scale Your Appointments Like a True Business Owner

Before, I had no real way of tracking:

📊 How many appointments I had per week or month

📊 How many of those appointments turned into applications

📊 How many applications turned into closings

Now, with my custom appointment dashboard, I can measure & improve every step.

And the best part? 🚀

👉 This calendar system is INCLUDED for FREE with your Dream Big CRM subscription.

Start Booking More Appointments & Closing More Deals Today

💥 No more wasting time on the wrong prospects.

💥 No more manually confirming meetings.

💥 No more relying on multiple systems to get the job done.

🚀 Book more appointments. Close more loans. Scale your business.

Social Media Management

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

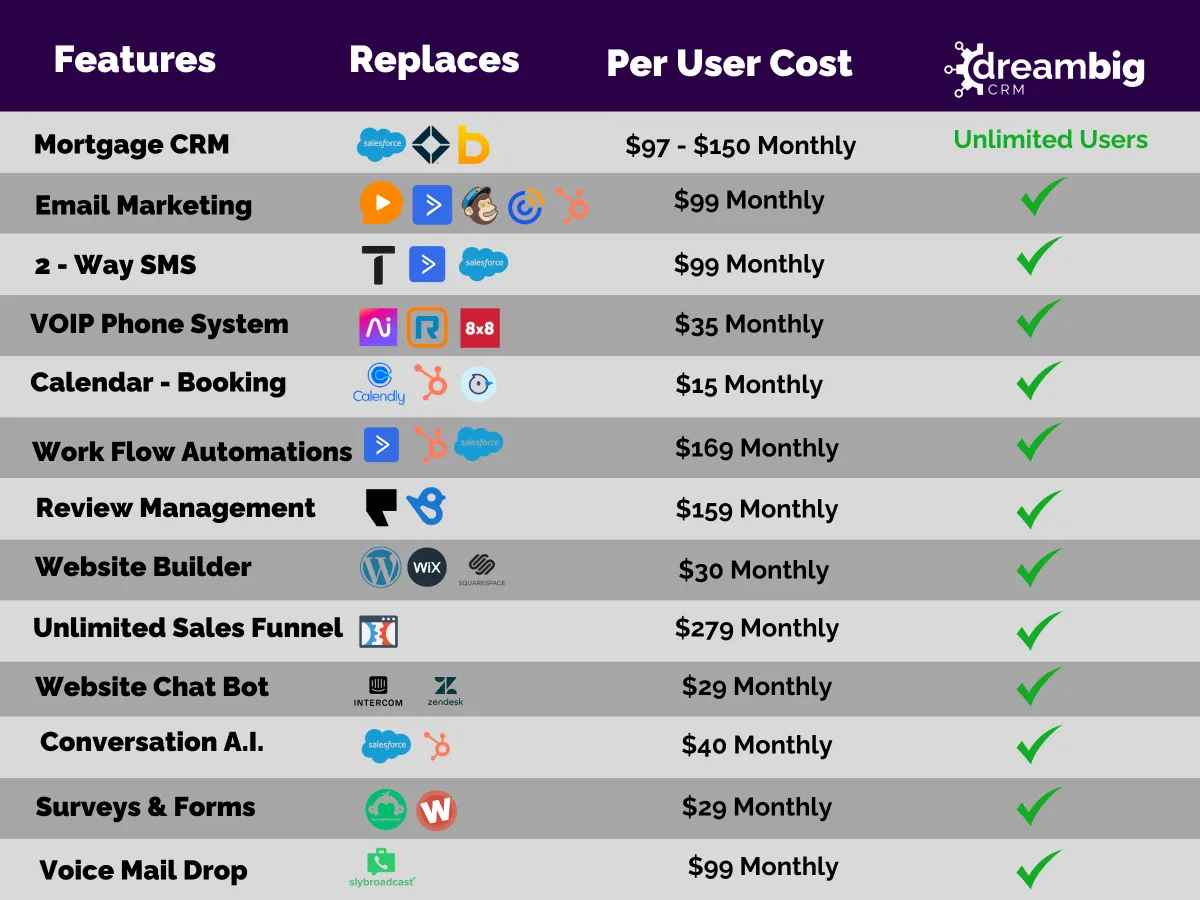

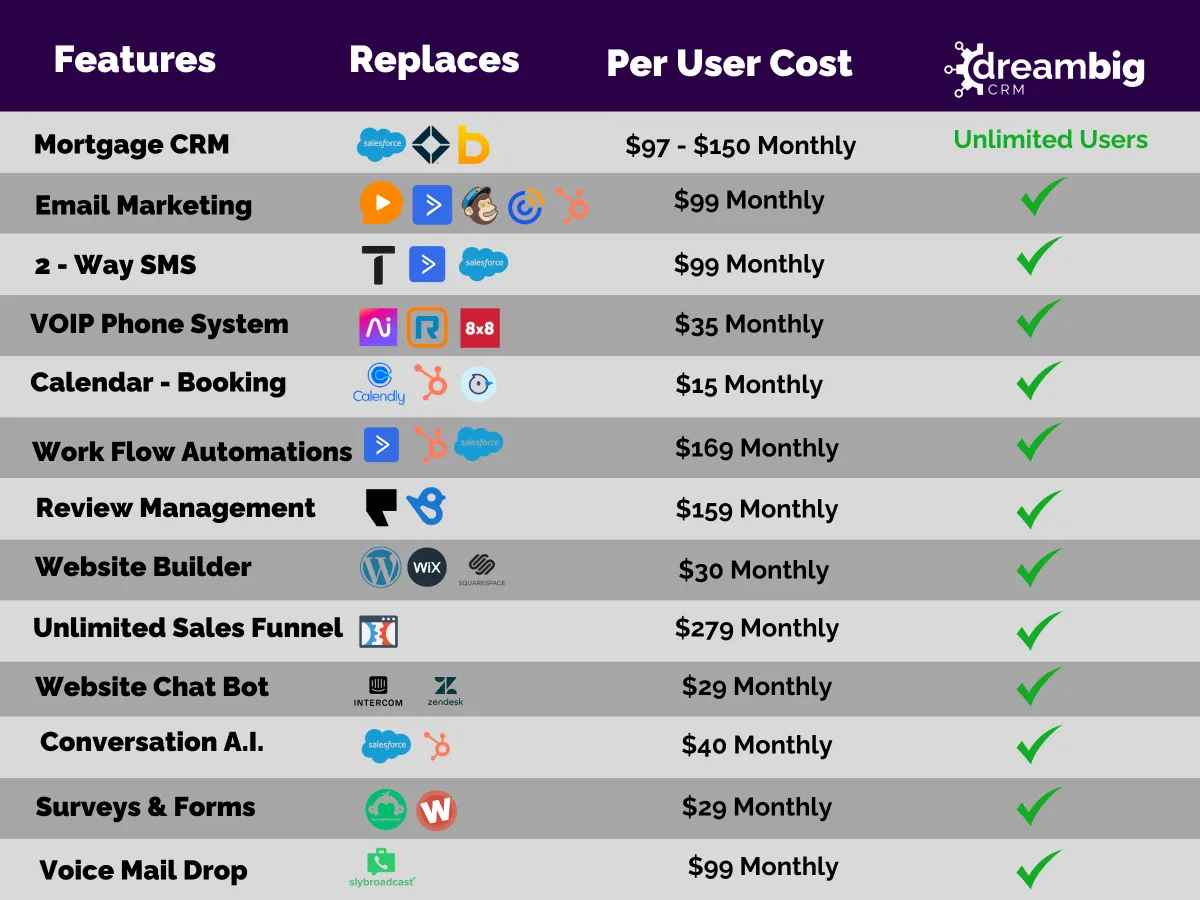

Cancel Your Other Subscriptions!

We Got All These Services Covered

Cancel Your Other Subscriptions!

We Got All These Covered

Welcome to the Future of

Mortgage CRMs

Don't Get Left Behind...

Retarget Contacts effortlessly.

Streamline Your Loan Process

Automate your Follow-ups & close more deals effortlessly

The Perfect Loan Process

Blue Print

Unlimited Users

No More Credit Report Fees

Welcome to the Future of

Mortgage CRMs

Don't Get Left Behind...

Retarget & Convert Your Contacts effortlessly.

Streamline Your Loan Process from Start to Finish

Automate your Follow-ups to close more deals effortlessly

The Perfect Loan Process Blue Print

Unlimited Users | Scale Your Business

Never Pay for a Credit Report Again

Feature & Benefit

Communicate with your team effortlessly.

Feature & Benefit

Send & Receive Group Text Messaging

Feature & Benefit

Never Pay for a Credit Report Again

Included

BONUS #1

$1,100.00 Value

FREE BONUS #1:

LOS API CONNECTION

– A $1,100 VALUE – We will

connect it for FREE!

Your Database is Your Business – Protect It, Automate It, Leverage It

Most loan officers don’t realize how critical it is to have full control over their database—until it’s too late.

If your data isn’t automatically updated with every loan application, you’re forced to manually enter client details, increasing the risk of errors, wasted time, and lost opportunities.

Early in my career, I had no idea how much time I was losing by manually inputting data into multiple systems. Even when I brought on a team to help, we still spent 15-20 minutes per loan just on double entry.

Then, I connected my CRM to my LOS (Loan Origination System), and everything changed.

Here's Why This Matters:

Every loan detail automatically syncs with your CRM—no manual entry required.

Accurate client records mean smarter, more effective marketing.

Save hours each month by eliminating double data entry.

Seamlessly track key loan details—PMI, homeowners insurance, HOA fees, and more.

Most CRMs charge extra for API setup—we normally charge $1,099 for this integration—but when you sign up today, we’re including it absolutely FREE.

Here are the systems we either have API already or are working on connecting:

Encompass (API Built & Completed)

Arive (API Built & Completed)

Lending Pad (Currently Building API) We will connect for you

CALYX Point (Currently Building API) We will connect for you

Data Privacy & Compliance – We’ve Got You Covered

We know compliance is critical. That’s why our platform, built on GoHighLevel’s secure infrastructure, ensures your data stays private, protected, and fully compliant with your company’s policies.

Secure API connections prevent unauthorized access

Strict data privacy standards—only essential information is collected

Advanced security measures to safeguard client information

Sign out from all devices for complete control over account access

We encourage you to work with your company to negotiate a favorable data policy for both parties—one that benefits both you as the loan officer and ensures the company’s data remains protected and secure.

Companies enforce strict policies (as they should) to prevent client data from being leaked, stolen, or misused.

By working with your company and advocating for fair & safe data practices, you can maintain impeccable records for your clients and dramatically improve your marketing efforts.

Included

BONUS #1

$1,100.00 Value

FREE BONUS #1:

LOS API CONNECTION – A $1,100 VALUE – We will

connect it for FREE!

Your Database is Your Business – Protect It, Automate It, Leverage It

Most loan officers don’t realize how critical it is to have full control over their database—until it’s too late.

If your data isn’t automatically updated with every loan application, you’re forced to manually enter client details, increasing the risk of errors, wasted time, and lost opportunities.

Early in my career, I had no idea how much time I was losing by manually inputting data into multiple systems. Even when I brought on a team to help, we still spent 15-20 minutes per loan just on double entry.

Then, I connected my CRM to my LOS (Loan Origination System), and everything changed.

Here's Why I Highly Recommend Connecting Your LOS:

Every loan detail automatically syncs with your CRM—no manual entry required.

Accurate client records means smarter, more effective marketing.

Save hours each month by eliminating double data entry.

Seamlessly track key loan details—PMI, homeowners insurance, HOA fees, and more.

Most CRMs charge extra for API setup—we normally charge $1,099 for this integration—but when you sign up today (This wont last), we’re including it absolutely FREE.

Here are the systems we either have API already or are working on connecting:

Encompass (API Built & Completed)

Arive (API Built & Completed)

Lending Pad (Currently Building API) We will connect for you

CALYX Point (Currently Building API) We will connect for you

We will connect others if needed with our amazing Tech Team.

Data Privacy & Compliance – We’ve Got You Covered

We know compliance is critical. That’s why our platform, built on GoHighLevel’s secure infrastructure, ensures your data stays private, protected, and fully compliant with your company’s policies.

Secure API connections prevent unauthorized access

Strict data privacy standards—only essential information is collected

Advanced security measures to safeguard client information

Sign out from all devices for complete control over account access

We encourage you to work with your company to negotiate a favorable data policy for both parties—one that benefits both you as the loan officer and ensures the company’s data remains protected and secure.

Companies enforce strict policies (as they should) to prevent client data from being leaked, stolen, or misused.

By working with your company and advocating for fair & safe data practices, you can maintain impeccable records for your clients and dramatically improve your marketing efforts.

Included

Bonus #2

$350.00 Value

FREE BONUS #2:

Full Database Migration—A $350.00 Value.

We Do All the Heavy Lifting for You!

Switching CRMs can feel overwhelming… but we’ve got you covered.

We’ll export, clean, and import your entire database into Dream Big CRM—so you don’t have to lift a finger.

We’ll Do the Hard Work—So You Can Stay Focused on Closing Loans!

Your Data Stays Intact—Every contact, every loan, every list transfers over seamlessly.

Loans Stay Attached to Clients—If a client has done 2, 3, or even 4 loans with you, those loans stay linked.

We Keep Your Lists Organized—First-time buyers, pre-approvals, closed loans—all your key lists stay intact.

Data Migration Done Right—Most CRMs leave this up to you (which can take HOURS), but we handle everything for FREE.

💰 Other companies charge $500+ for this service… but when you sign up today, you get it 100% FREE.

Included

Bonus #2

$350.00 Value

BONUS #2: Full Database Migration—

We Do All the Heavy Lifting for You!

Switching CRMs can feel overwhelming… but we’ve got you covered.

We’ll export, clean, and import your entire database into Dream Big CRM—so you don’t have to lift a finger.

We’ll Do the Hard Work—So You Can Stay Focused on Closing Loans!

Your Data Stays Intact—Every contact, every loan, every list transfers over seamlessly.

Loans Stay Attached to Clients—If a client has done 2, 3, or even 4 loans with you, those loans stay linked.

We Keep Your Lists Organized—First-time buyers, pre-approvals, closed loans—all your key lists stay intact.

Data Migration Done Right—Most CRMs leave this up to you (which can take HOURS), but we handle everything for FREE.

💰 Other companies charge $500+ for this service… but when you sign up today, you get it 100% FREE.

Included

BONUS #3

$500.00 Value

FREE BONUS #3:

Full Onboarding & Training For Free – A $500.00 VALUE – Get your business up & running today.

Most CRMs leave you to figure everything out on your own…

Not here....

We don’t just hand you the keys—we jump in the car with you and show you exactly how to drive! 🚀

Here’s What You Get With Your Onboarding:

We don’t just hand you the keys—we jump in the car with you and show you exactly how to drive! 🚀

We don’t just hand you the keys—we jump in the car with you and show you exactly how to drive! 🚀

Weekly Live Zoom Calls—Answering all your questions in a group setting. Jump on anytime. We record our calls and post them in the community.

We have over 40+ Step-by-Step Video Tutorials—Learn everything from creating contacts, scheduling appointments, automating workflows, and even working with AI!

Exclusive Online Community Access—Get ongoing support, watch weekly training videos, and stay ahead with the latest marketing strategies.

Our Team Does the Heavy Lifting—So You Can Start Closing Deals Faster!

We can’t waive our onboarding costs forever—this is a limited-time opportunity to get set up the right way, completely FREE.

Don’t wait! Get started today, and we guarantee you won’t be disappointed.

🚀🔥

Included

BONUS #3

$500.00 Value

FREE BONUS #3:

Full Onboarding & Training For Free – A $500 VALUE – Get your business up and running today.

Most CRMs leave you to figure everything out on your own…

Not here....

We don’t just hand you the keys—we jump in the car with you and show you exactly how to drive! 🚀

Here’s What You Get With Your Onboarding:

We don’t just hand you the keys—we jump in the car with you and show you exactly how to drive! 🚀

We don’t just hand you the keys—we jump in the car with you and show you exactly how to drive! 🚀

Weekly Live Zoom Calls—Answering all your questions in a group setting. Jump on anytime. We record our calls and post them in the community.

We have over 40+ Step-by-Step Video Tutorials—Learn everything from creating contacts, scheduling appointments, automating workflows, and even working with AI!

Exclusive Online Community Access—Get ongoing support, watch weekly training videos, and stay ahead with the latest marketing strategies.

Our Team Does the Heavy Lifting—So You Can Start Closing Deals Faster!

We can’t waive our onboarding costs forever—this is a limited-time opportunity to get set up the right way, completely FREE.

Don’t wait! Get started today, and we guarantee you won’t be disappointed.

🚀🔥

The Full Breakdown of What’s Included

15 Day Free Trial $297

Los Integration $1100

Data Migration $350

Onboarding $500

40+ Training Videos $500

Weekly Zoom Trainings $1,000

Start Today $0.00

The Full Breakdown of What’s Included

15 Day Free Trial

Los Integration

Database Migration

Onboarding

40+ Training Videos

Weekly Zoom Trainings

Value

$297.00

$1,100

$350.00

$500.00

$1,997.00

$1000

$5,244

Get Started

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

STILL NOT SURE?

Frequently Asked Questions

Everything You Need to Know

Before Getting Started! 🚀

Question 1: What makes Dream Big CRM different from other mortgage CRMs?

Most mortgage CRMs are expensive and force you to patch together multiple tools—expecting you to be a tech expert or hire outside help just to make it work.🚀 With Dream Big CRM, we’ve done the heavy lifting for you. We’ll help you customize, automate, and build your mortgage CRM exactly the way you envision—without the hassle.

Question 2: I’m not tech-savvy. Is this CRM easy to use?

Yes! Dream Big CRM is built for loan officers, not tech experts. Our system is intuitive, easy to navigate, and requires no coding or technical skills. Plus, we handle the setup, automation, and customization for you, so you can focus on closing deals—not figuring out software. You’ll also get 1-on-1 onboarding, weekly live training, and 40+ step-by-step video tutorials to make sure you’re up and running fast. If you ever have questions, our support team and online community are always here to help! 🚀

Question 3: Can I customize the CRM to fit my unique loan process?

Dream Big CRM is fully customizable to fit your unique loan process. We’ve already built a proven blueprint for the perfect loan workflow—you simply tweak it to match your style.🚀 Customize pipelines, automations, workflows, and appointment types to fit how you do business. Personalize follow-ups, loan milestones, team tasks, and client communication with ease.And you’re never on your own—our 1-on-1 onboarding and ongoing support ensure you have everything set up exactly how you want—without the hassle.

Question 4: Do I have to sign a long-term contract??

No. Your CRM is always a month to month service. We know that life happens. If you need to cancel or pause your service we understand.

Question 5: Does this CRM integrate with my Loan Origination System (LOS)?

Yes. We have built many API connections including Encompass, Arive, and other mortgage Loan Origination Systems. Our commitment to you is we will build your LOS api if we have not yet built it for your LOS before. We are including the API/integration for free today but will not be able to do this for much longer.

Question 6: What happens if I want to cancel? Will I lose my data or

You can cancel anytime—no long-term contracts, no hidden fees. If you decide to cancel, you’ll still have access to your data and can export your contacts, notes, and important information before your account closes. We believe in earning your business every month, so there’s no pressure—just a powerful CRM designed to help you grow!

STILL NOT SURE?

Frequently Asked Questions

Everything You Need to Know Before Getting Started! 🚀

Question 1: What makes Dream Big CRM different from other mortgage CRMs?

Most mortgage CRMs are expensive and force you to patch together multiple tools—expecting you to be a tech expert or hire outside help just to make it work.🚀 With Dream Big CRM, we’ve done the heavy lifting for you. We’ll help you customize, automate, and build your mortgage CRM exactly the way you envision—without the hassle.

Question 2: I’m not tech-savvy. Is this CRM easy to use?

Yes! Dream Big CRM is built for loan officers, not tech experts. Our system is intuitive, easy to navigate, and requires no coding or technical skills. Plus, we handle the setup, automation, and customization for you, so you can focus on closing deals—not figuring out software. You’ll also get 1-on-1 onboarding, weekly live training, and 40+ step-by-step video tutorials to make sure you’re up and running fast. If you ever have questions, our support team and online community are always here to help! 🚀

Question 3: Can I customize the CRM to fit my unique loan process?

Dream Big CRM is fully customizable to fit your unique loan process. We’ve already built a proven blueprint for the perfect loan workflow—you simply tweak it to match your style.🚀 Customize pipelines, automations, workflows, and appointment types to fit how you do business. Personalize follow-ups, loan milestones, team tasks, and client communication with ease.And you’re never on your own—our 1-on-1 onboarding and ongoing support ensure you have everything set up exactly how you want—without the hassle.

Question 4: Do I have to sign a long-term contract??

No. Your CRM is always a month to month service. We know that life happens. If you need to cancel or pause your service we understand.

Question 5: Does this CRM integrate with my Loan Origination System (LOS)?

Yes. We have built many API connections including Encompass, Arive, and other mortgage Loan Origination Systems. Our commitment to you is we will build your LOS api if we have not yet built it for your LOS before. We are including the API/integration for free today but will not be able to do this for much longer.

Question 6: What happens if I want to cancel? Will I lose my data or

You can cancel anytime—no long-term contracts, no hidden fees. If you decide to cancel, you’ll still have access to your data and can export your contacts, notes, and important information before your account closes. We believe in earning your business every month, so there’s no pressure—just a powerful CRM designed to help you grow!

Launch Your CRM TODAY!! Save the $1,950 onboarding fee today by starting your 15 day trial today.. This discount will only last

until the time runs out.

Enter the Coupon Code "IDREAMBIG" to save $1,950 onboarding fee

We simply cannot give away the cost to onboard for very much longer.

Launch Your CRM TODAY & Save $1950 onboarding fee by starting your 15 day trial today.. This code will only last until the time runs out.

Enter the Coupon Code "IDREAMBIG" to save $1950 onboarding fee

We simply cannot give away our onboarding cost for very much longer.

DREAM BIG CRM VS (Coming Soon)

Dream Big CRM vs Salesforce | Jungo

Dream Big CRM vs ADIAM

Dream Big CRM vs SUREFIRE

Dream Big CRM vs Total Expert

About Dream Big CRM

Blogs

Events

CONTACT US

Corporate HQ

2777 Bechelli Lane

Redding Ca 96002

Phone: (530) 999-0075

Email: [email protected]